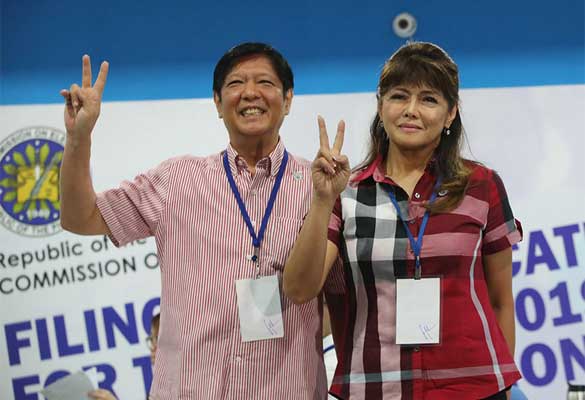

The Philippines’ economy grew faster than the projection in the first quarter, raising speculation of interest rate hikes to combat growing inflation. It is a crucial concern that the country’s newly-elected President Ferdinand Marcos Jr is facing.

The Southeast Asian country’s gross domestic product (GDP) increased by 8.3% year-over-year in January-March, exceeding expectations and outpacing the previous quarter’s 7.7% growth.

The growth was indeed been the fastest since the second quarter of 2021 when it hit 12.1%.

The Bangko Sentral ng Pilipinas (BSP), the country’s central bank, will be meeting on May 19 amid increased anticipation of an interest rate hike to curb rising prices. It has recently been left unchecked, which in turn might endanger the economy.

Nicholas Mapa, senior executive for the Philippines at ING said that this strong recovery of the economy with the above-target inflation points to policy normalization from the Bangko Sentral ng Pilipinas.

He further said that the Philippines BSP Governor Diokno has been keeping the rates unchanged so as to help support the recovery of the economy. However, with the GDP now back to pre-COVID-19 levels, along with the inflation accelerating.

It is expected that BSP will hike policy rates during the May 19 meeting. It also expects the average for the full year to hit 4.3% but predicts that the inflation will ease to the given target in 2023.

Ferdinand Marcos Jr will be taking over the presidency in June after the end of the 6-year term of Rodrigo Duterte.